Coming in many forms, fraud leaves online store owners with extra expenses, loss of inventory, and questions about which purchases are actually legitimate or not. That’s why all online stores need fraud prevention and risk analysis tools. Prodigy Commercebelieves that you shouldn’t have to pay to protect your store. Therefore, all Prodigy developers and store owners gain access to a built-in risk analysis tool, fully integrated and provided by MaxMind minFraud.

Through its partnership with MaxMind, Prodigy provides a completely free fraud detection and analysis feature with the ability to check risk scores for all transactions through the analysis of customer ISPs, addresses, credit cards, and contact information.

What’s more is that Prodigy covers the cost for all MaxMind minFraud queries, whereas other eCommerce platforms, or those using MaxMind minFraud without Prodigy, have to pay per query.

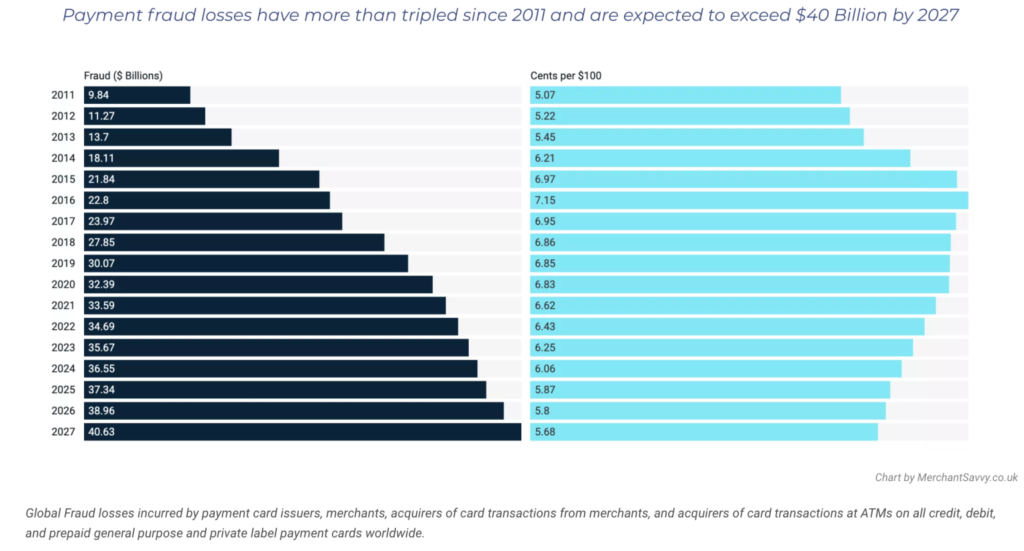

With global online payment fraud tripling from 2011 to 2020 (costing more than $32 billion), it’s about time store owners had the opportunity to complete fraud analysis without the ongoing costs and unnecessary extra dashboard. In Prodigy, it’s all free and consolidated in your online store’s dashboard.

Keep reading to learn all about Prodigy’s integration with MaxMind minFraud. We compare it to WooCommerce’s Anti-fraud plugin and outline the most important features for you to prevent fraud and save time and money in the future.

A Comparison: Prodigy’s MaxMind minFraud Integration vs the WooCommerce Anti-fraud Plugin

| Anti-fraud | ||

|---|---|---|

| Solution | MaxMind minFraud Integration | Anti-fraud Plugin |

| Price | Free | $79 per year |

| Cost to run a risk analysis | Free | From $0.005 to $0.02 for every query |

| Integration | Built into Prodigy Commerce | Requires a third-party plugin and separate dashboard |

| Account Setup | Pre-established account with MaxMind minFraud | You must sign up for your own MaxMind minFraud account |

| IP address analysis | Yes | Yes |

| Risk score for each transaction | Yes | Yes |

| Credit card analysis | Yes | Yes |

| Email and location analysis | Yes | Yes |

Risk Analysis Features That Come with Prodigy Commerce

Besides the fact that you save $79 per year (if you were to go with WooCommerce and its fraud plugin) and up to $0.02 per risk analysis query, the Prodigy/minFraud combination also offers an incredible collection of features to identify fraud through the most common criminal tactics.

Here’s what to expect:

An Overall Risk Score

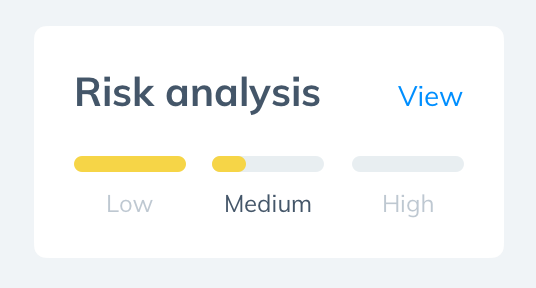

To make your analysis simple, minFraud displays a quick Risk Score in the Prodigy Dashboard whenever a transaction comes through your online shop.

The summary score compiles a wide range of fraud tests to end up with a score that’s between 0 and 100, where a 0 indicates virtually no risk, and 100 tells you something is probably wrong with the order.

The risk levels are as follows:

- Low risk – 0 to 10 risk score

- Medium risk – 10 to 30 risk score

- High risk – 30 to 100 risk score

IP (Internet Protocol) Address Analysis

Every computer and browser has its own IP address, unless it gets blocked from display by the user. A common way to identify fraud is to see if the IP address location corresponds with the shipping country, billing address, and billing country.

For instance, it’s suspicious to see an order with an IP address from Bangladesh but the shipping country set as Germany. That essentially shows that someone in Bangladesh could be trying to use a credit card stolen from someone in Germany.

This particular Prodigy Commerce feature takes the customer’s IP address and puts it through a series of rigorous tests, some of which include:

- Seeing if the IP location matches the billing country.

- Checking if the IP location matches the order’s billing address.

- Determining if the IP location matches the shipping country.

- Figuring out how far the IP location is from the shipping address (someone could be sending a gift or shipping to their office if it’s nearby).

All of those tests come together to complete the IP Address Risk Score, which looks similar to the Overall Risk Score, with results ranging from 0 to 100 (the lower the better).

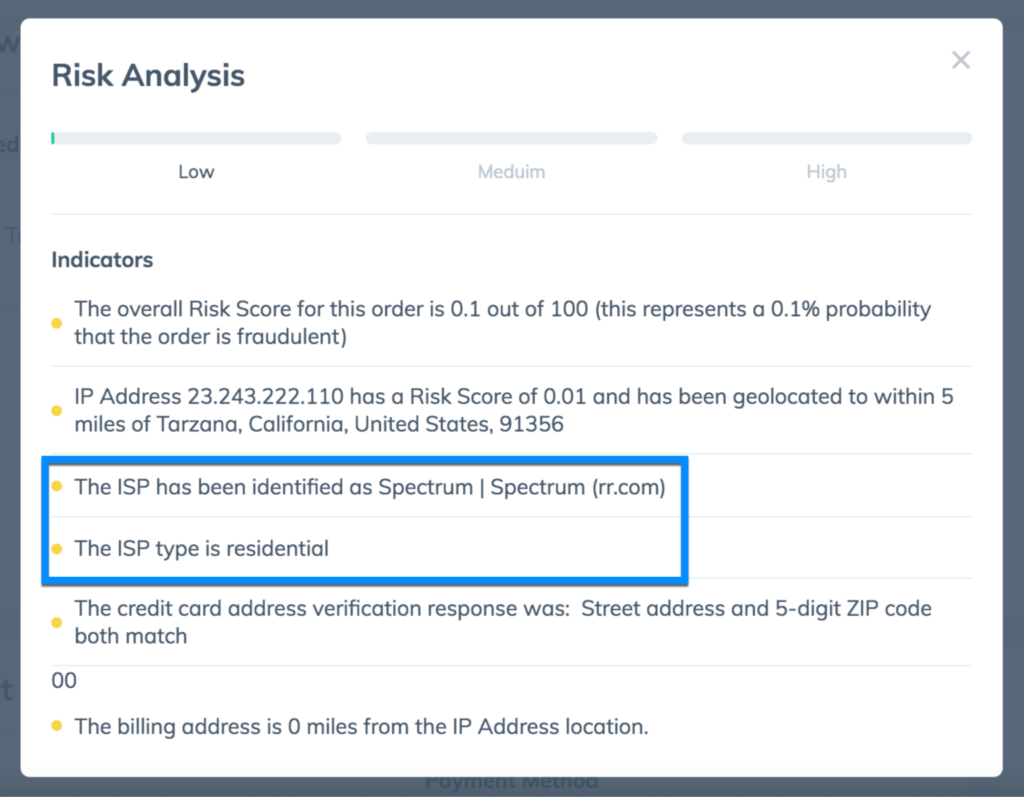

ISP (Internet Service Provider) Tracking

An internet service provider is a company your customer (or potential fraudulent customer) pays to get their internet. Some common ISPs include AT&T, Spectrum, Xfinity, and RCN.

With Prodigy Commerce’s risk analysis, you receive information about the customer’s ISP, such as the web domain, name, and type of ISP.

The goal is to look into orders with less-than-reputable ISPs, or those with strange ISP types.

Credit Card Analysis

A credit card holds quite a bit of information to help with fraud detection, most notably cross-referencing the credit card details with order elements like shipping addresses and IP locations.

When a customer types in a credit card number, Prodigy and minFraud go to work to look into the following:

- Whether the credit card issuer country matches that of the billing country inserted in the order.

- If the credit card holder’s address can be verified.

- If the person typed in the right CVV number from the credit card used in the transaction. (This is the security code on the back of a credit card. It’s usually three or four digits).

Notifications for High-risk Customers

Sometimes high-risk transactions get determined by one identifier, like an IP address that’s on a blacklist or someone who’s intentionally blocking their IP address.

The minFraud feature in Prodigy scans for all of these instances:

- High-risk shipping addresses that have ended up on blacklists or are located in high-fraud areas.

- Questionable email addresses that have gotten flagged in the past for fraud.

- Those using satellite ISPs, which have been shown to slightly increase risk when it comes to online shopping.

- Blocked, or anonymous, internet service provider information or IP addresses.

Shipping and Billing Address Matching and Analysis

Finally, the Prodigy risk analysis system takes the basic postal information from the order to see if something doesn’t add up.

For example, it may find that the shipping postal code doesn’t match the city in the shipping fields. The same can be said for billing addresses, where the billing postal code doesn’t align with the billing city.

How to Access the MaxMind minFraud Features in the Prodigy Dashboard

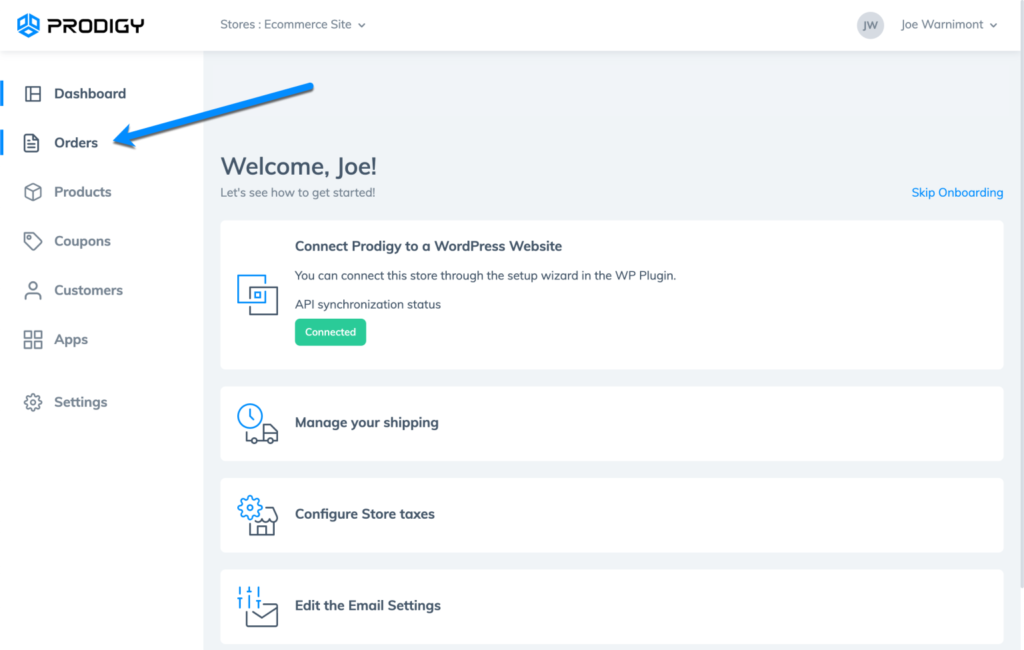

Each transaction you receive in Prodigy goes through the risk analysis process. Therefore, you can find the minFraud reports by going to your Prodigy Dashboard and clicking on the Orders tab.

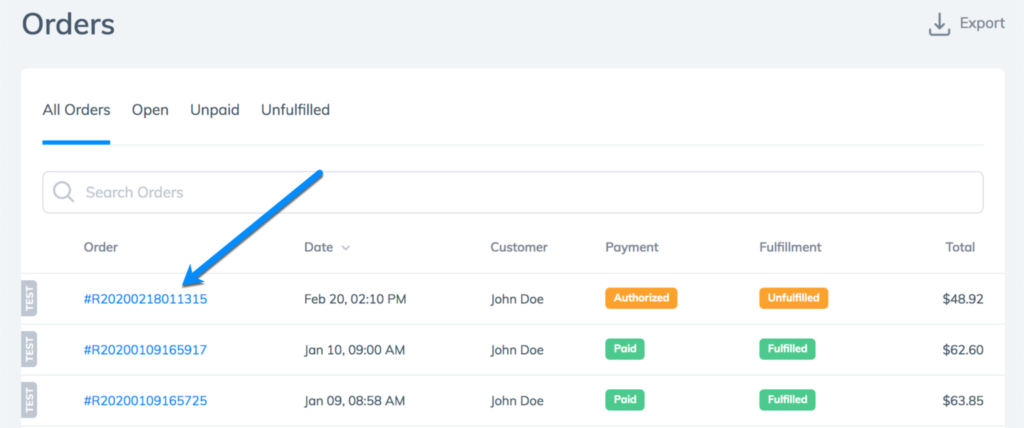

After that, scroll through the list of recent orders and click on the order number for the transaction in question.

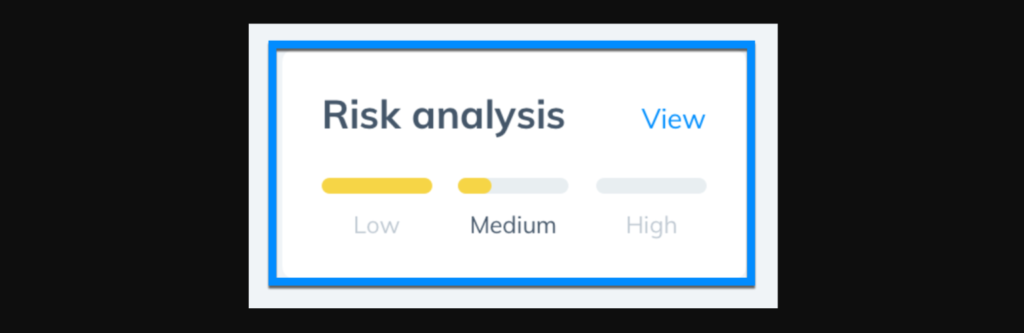

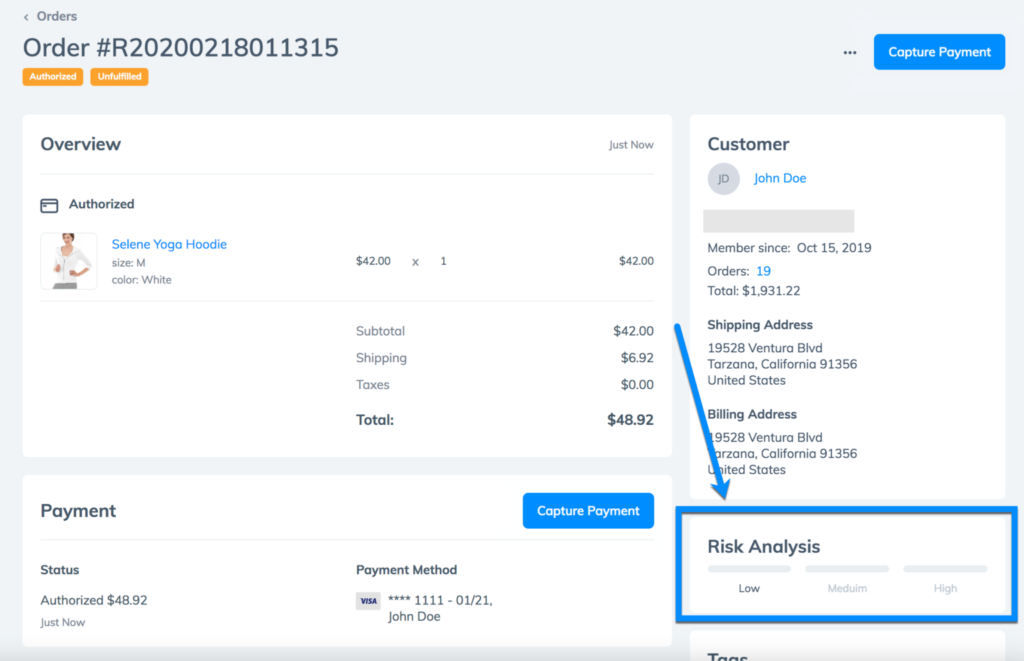

You’ll see a Risk Analysis box to the right of the order details. The box provides a quick scale of the order’s risk potential, ranging from low to high.

Click the View button for more details.

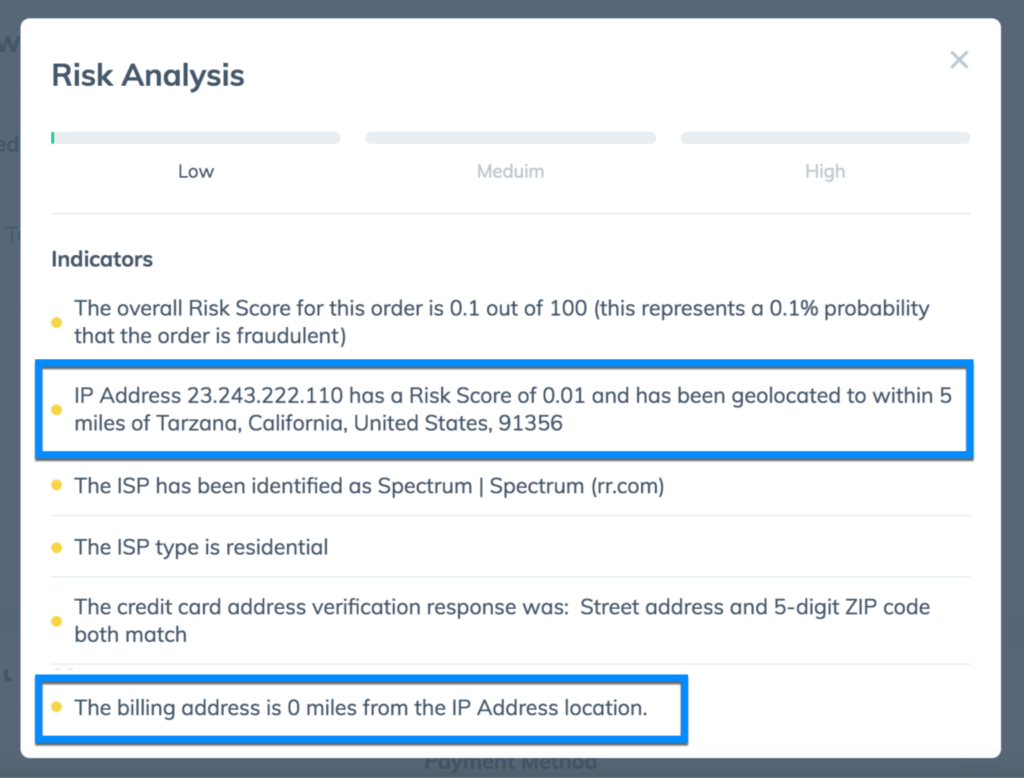

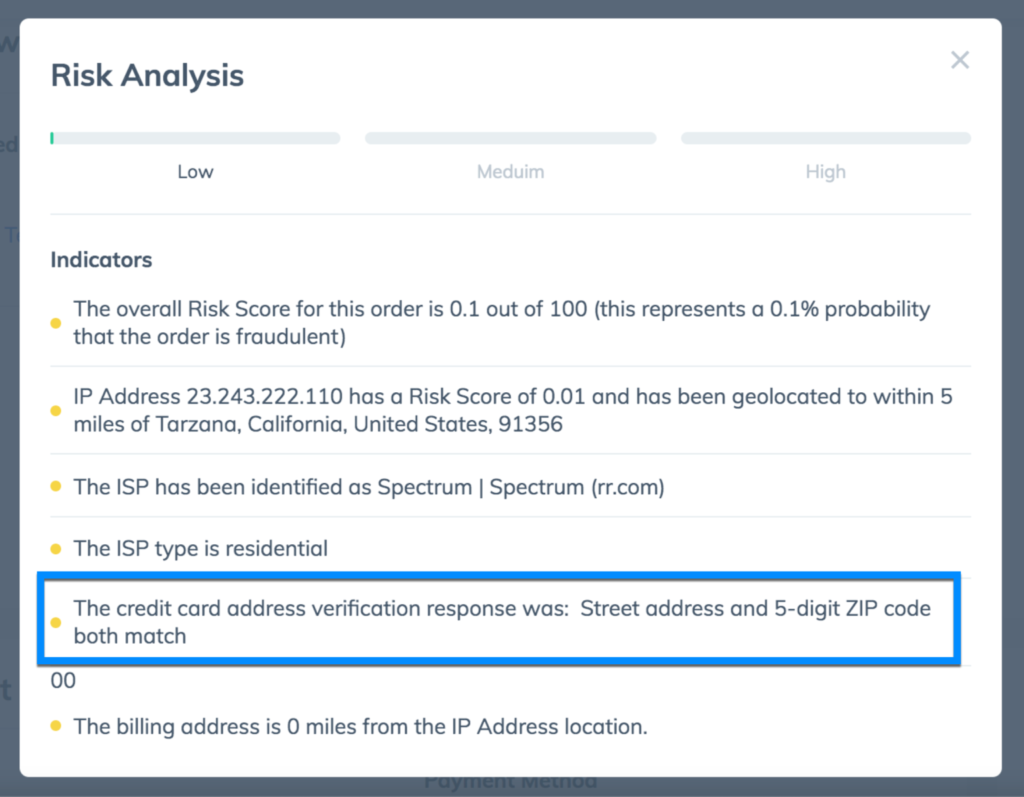

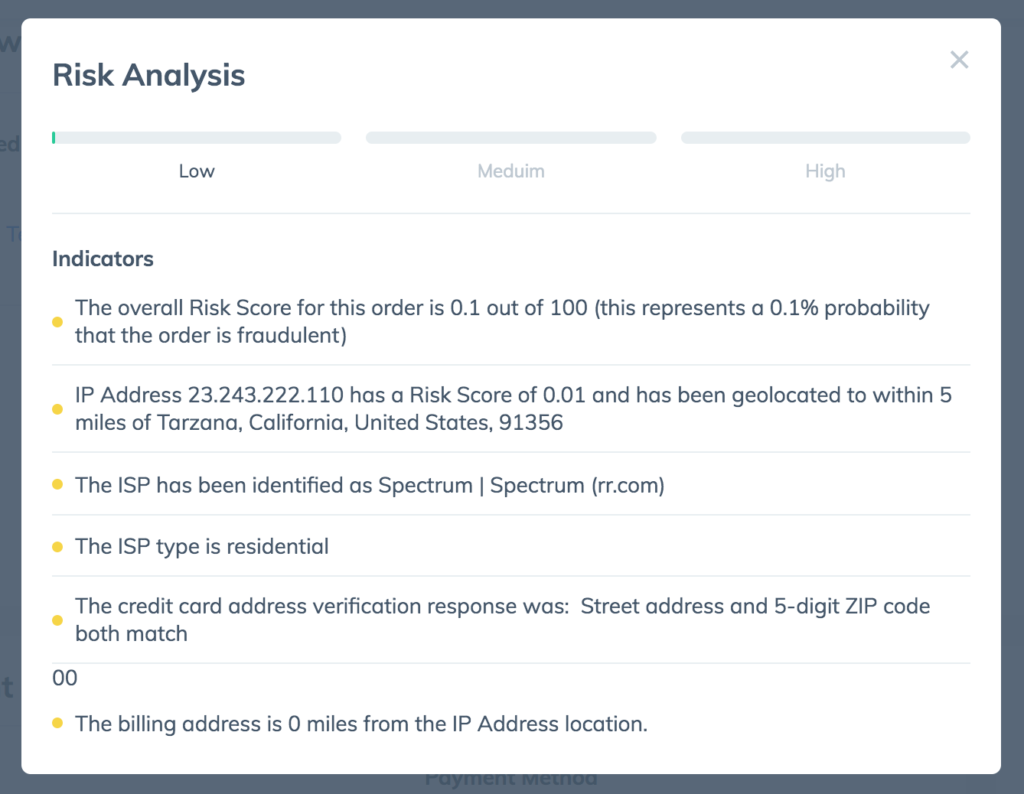

This page has a list of risk indicators from the order. It’s essentially a summary of why the order’s risk potential is at its current level. It also provides more information to you, the developer or store owner, helping you understand how fraud tends to occur in the eCommerce world.

For instance, this particular order is flagged as low, because of metrics like the billing address being 0 miles from the IP address location, or the credit card street address matching the 5-digit zip code.

Note: The fraud detection and risk analysis feature from Prodigy is not shown for stores in Development Mode. You must switch the store to Live Mode to accept orders and activate the risk testing.

More Fraud Tools Included for Free: Google’s Invisible reCAPTCHA to Prevent Card Testing Fraud

Prodigy’s MaxMind minFraud integration takes the guesswork out of fraud detection by providing elements like risk scores, IP checks, and confidence factors.

In addition to that, Prodigy continues to roll out fraud minimization features, one of which is Google’s Invisible reCAPTCHA tool.

As with all features included with Prodigy, the invisible reCAPTCHA offers a direct integration with your online store, and it doesn’t cost developers or store owners a cent.

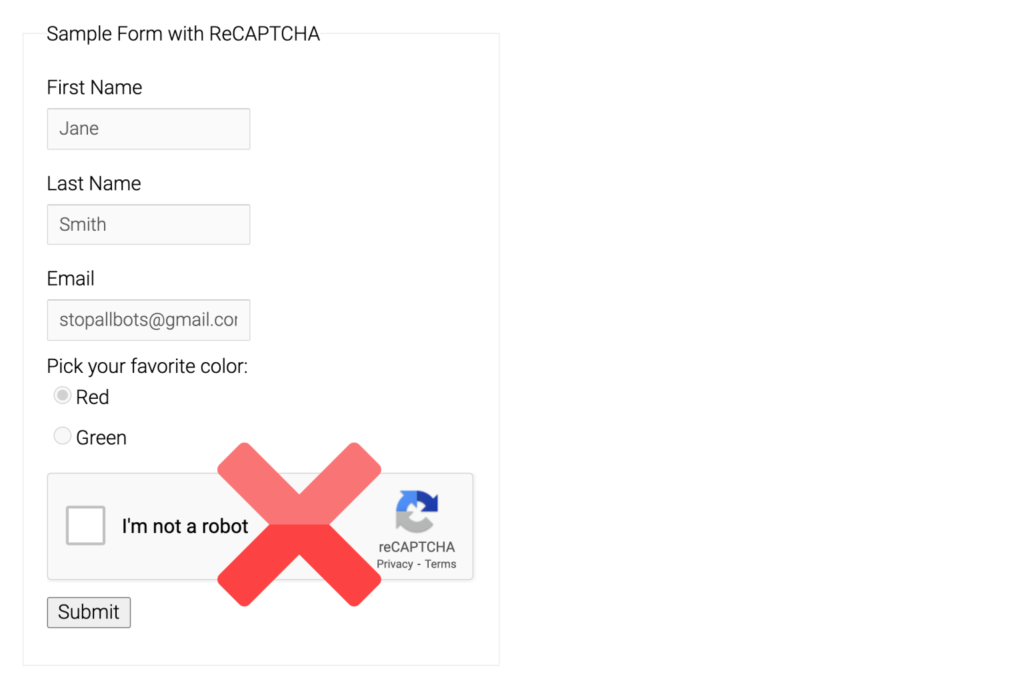

reCAPTCHA tools have historically worked well to prevent instances where criminals use bots to test thousands of stolen credit cards until they find a valid one. These cases of fraud hurt consumers as well as merchants, seeing as how those transactions may get disputed, costing the merchants valuable time and a chargeback fee.

However, reCAPTCHA technology has a reputation for its distracting nature, slowing down the purchasing process for customers, and potentially requiring them to complete a test.

That’s why Prodigy chose Google’s Invisible reCAPTCHA system. It hides behind the online store and constantly analyzes purchases and customers to identify suspicious activity, all without some sort of pesky test.

WooCommerce does not require store owners to use any form of reCAPTCHA, let alone invisible reCAPTCHA. As a result, WooCommerce merchants are frequently attacked.

Unfortunately, it doesn’t take long for the criminals to submit thousands of fraudulent authorization card testing transactions. At $0.30 per test, which typically isn’t reimbursed in cases of fraud, store owners can quickly lose hundreds of thousands of dollars, which can cripple their cash flow, lead to the freezing of their merchant account, and potentially place their business in collections.

Benefits of the Prodigy integration with Google’s Invisible reCAPTCHA feature include:

- Real-time card testing prevention.

- A decrease in time spent monitoring this activity yourself.

- Minimization of costly chargeback fees.

- Minimization of transaction processing fees, which usually aren’t reimbursed after fraud occurs.

- Hidden fraud detection, as opposed to clunky, distracting reCAPTCHA forms that tend to annoy customers or even send them away from your site.

Get Started with Prodigy Commerce for Free, Fully-integrated Fraud Prevention and Risk Analysis

Sign up for Prodigy today to take advantage of a revolutionary, free eCommerce platform built for WordPress developers. Learn more about the platform here, like how Prodigy pays you to use the system. Feel free to contact Prodigy by phone, email or initiate a chat if you have any questions.