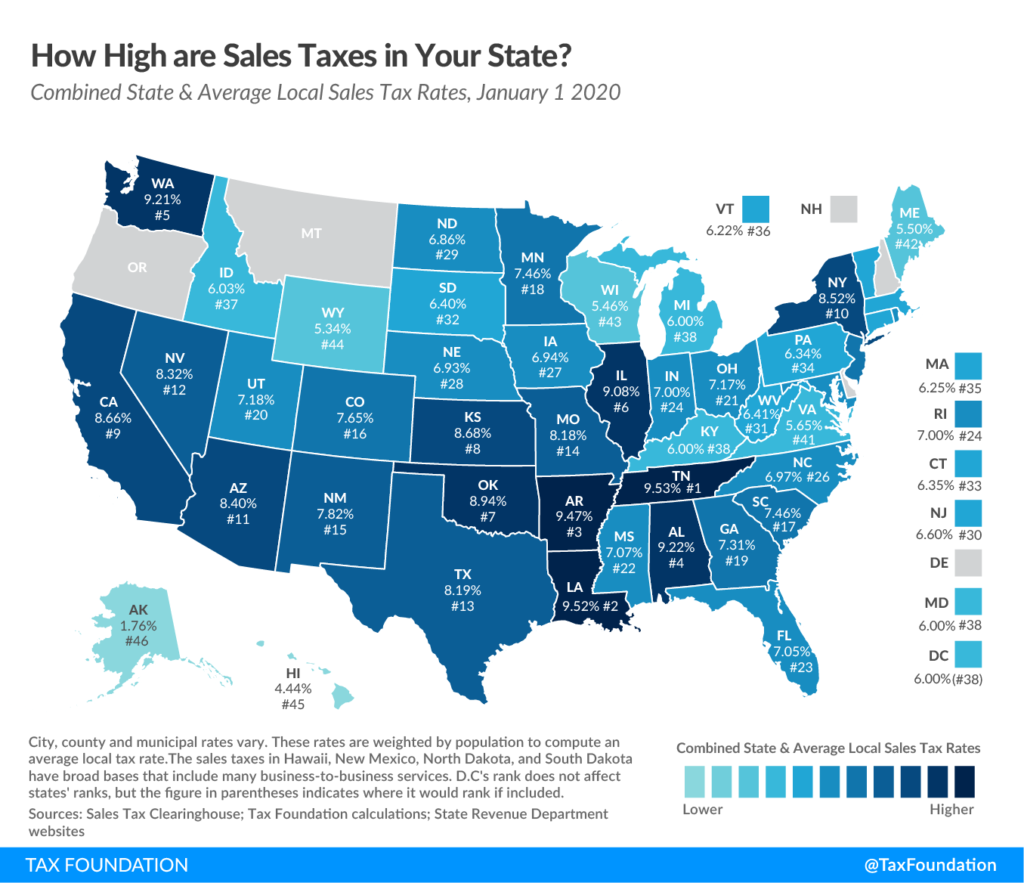

45 states, and the District of Columbia, collect statewide sales taxes. All of these state taxes vary, and to make matters more complicated, additional local sales taxes (county, district, etc.) get collected in 38 of those states. With the potential for so many different taxes on online sales, eCommerce businesses must have a reliable, real-time tax calculator built into their websites. That’s why the Prodigy Commerce platform for WordPress includes a seamless tax calculator (free of charge) for all store owners.

This feature is provided as a seamless TaxJar integration, allowing merchants to type in nexus locations and generate immediate tax calculations when customers go through the checkout process.

Keep reading to learn all about the features included with Prodigy’s tax integration. We also compare it to the various TaxJar plugins available for WooCommerce.

How Tax Calculations Work in Prodigy Commerce

What can you expect from Prodigy when it comes to tax calculations and the associated costs?

Read the sections below to understand the primary features and benefits.

1. Prodigy Taxes are Handled Through a Discrete TaxJar Integration

ECommerce tax integrations usually require you to install a separate plugin, make an account for a service like TaxJar, and often manage tax calculations, reports, and nexuses from multiple dashboards or an isolated section of the WordPress dashboard.

Prodigy, on the other hand, offers a built-in tax calculation tool by way of a sleek TaxJar integration.

There’s no need to install an extra plugin. There’s no need to create your own TaxJar account. There’s no need to jump from dashboard to dashboard. It’s all consolidated under one simple Tax Settings’ section on the Prodigy platform.

This configuration works because Prodigy uses a TaxJar developer account, which is integrated into the platform so that store owners gain the benefits of TaxJar without pesky plugins.

It’s such a clean integration that you won’t even know that TaxJar is behind the scenes handling tax calculations.

2. All Tax Calculations are Free of Charge for Merchants

In today’s eCommerce world, automated tax calculations cost money.

A TaxJar account is required when you install a TaxJar WooCommerce plugin. TaxJar has two accounts: a Starter plan for $19 per month and a Professional plan for $99 per month. Those both have limits of 200 orders per month. Most eCommerce stores must go with the Professional plan since that’s the only plan with sales tax automation. So, $99 per month is the minimum cost. Pricing increases based on order volume.

In addition, all WooCommerce stores with this setup should expect to pay roughly $0.02 – $0.002 per tax calculation.

Let’s do some quick math:

- $99 per month = $1,188 per year.

- 200 transactions per month at $0.02 per order = $48 per year.

That means it’s a minimum of $1,236 per year to add automated tax calculations to an eCommerce solution like WooCommerce–and it only increases when you pass 200 orders per month.

Those costs really add up. So Prodigy decided to get rid of them all.

The TaxJar feature is fully integrated using Prodigy’s own TaxJar developer account, so that $99 per month subscription fee drops to $0.

In addition, Prodigy absorbs all tax calculation fees, so you don’t have to worry about that extra $0.02 – $0.002 cost for each transaction.

Note: Store owners are more than welcome to create their own separate TaxJar account as well if they’d like access to more advanced tax filing features outside of Prodigy.

Fully Automated Tax Calculations

A common feature in WooCommerce TaxJar plugins is the ability to manually add rate tables and zones. That’s helpful for avoiding costs associated with automated tax calculations, but you don’t pay anything for taxes in Prodigy, so there’s no reason to stick with cumbersome manual input methods.

Overall, manually typing in zones, rates, and other tax information makes for a clunky, time-consuming, and often inaccurate experience.

Prodigy intentionally decided against this approach by instead offering a completely automated tax calculation system for free.

Coming Soon: Automated Tax Filing with Your Own TaxJar Account

Automated tax calculations are already available through Prodigy; you don’t even need to create a TaxJar account!

However, some store owners enjoy running their own TaxJar accounts due to its ability to automate tax filings. That’s why Prodigy plans to release a future feature for connecting your own TaxJar account, helping you generate tax filings directly through TaxJar.

Prodigy vs WooCommerce: A Comparison of Tax Calculations and Settings

| TaxJar Integration vs TaxJar Plugin | ||

|---|---|---|

| Real-time Rates and Calculations? | Yes. | Yes. |

| TaxJar Account Cost | $0. | $99 per month. |

| Tax Calculation Fee | $0. | $0.02 – $0.002 per calculation. |

| 3rd-party Plugin Required? | No. | Yes. |

| Free, Automated Calculations? | Yes. | You can manually type in nexus locations for free. Automation is available for a fee. |

| Automated Tax Filings? | Coming Soon. Manual filing is currently possible. | Yes, with a paid TaxJar account. |

| Unlimited Nexus Locations? | Yes. | Yes. |

How to Configure Store Taxes in Prodigy Commerce

The tax setup in Prodigy only takes a few clicks.

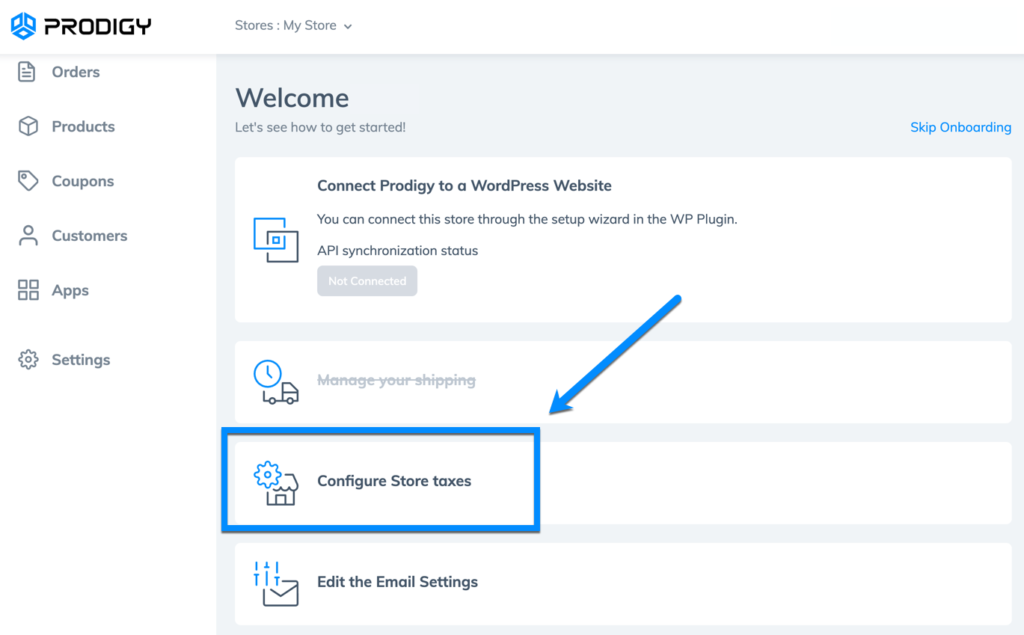

One way to access tax settings is to select the Configure Store Taxes button inside the Onboarding guide.

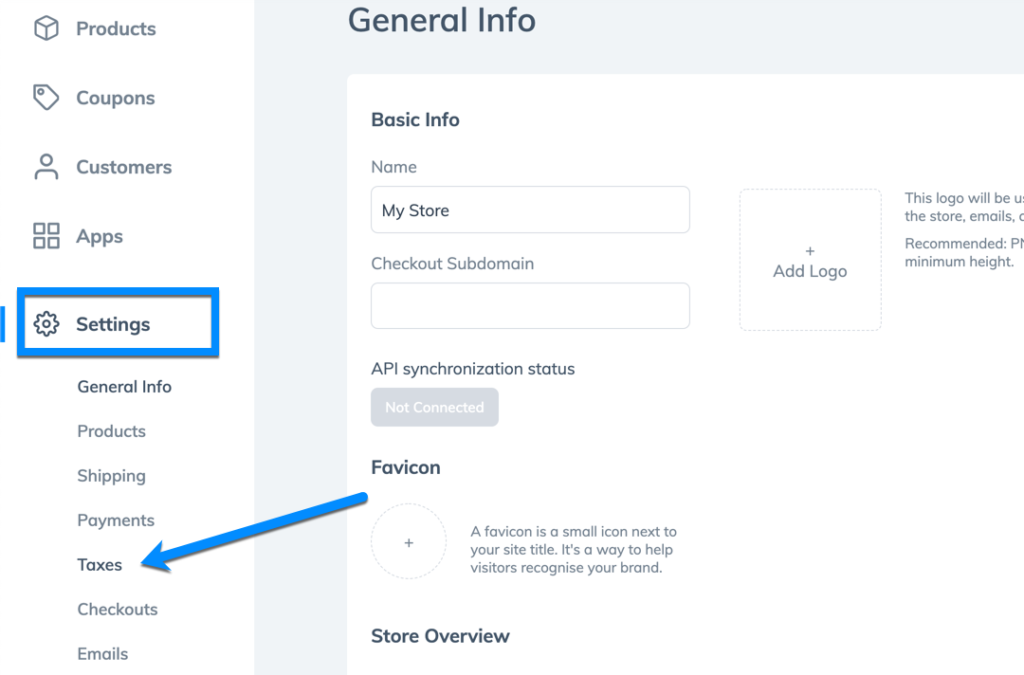

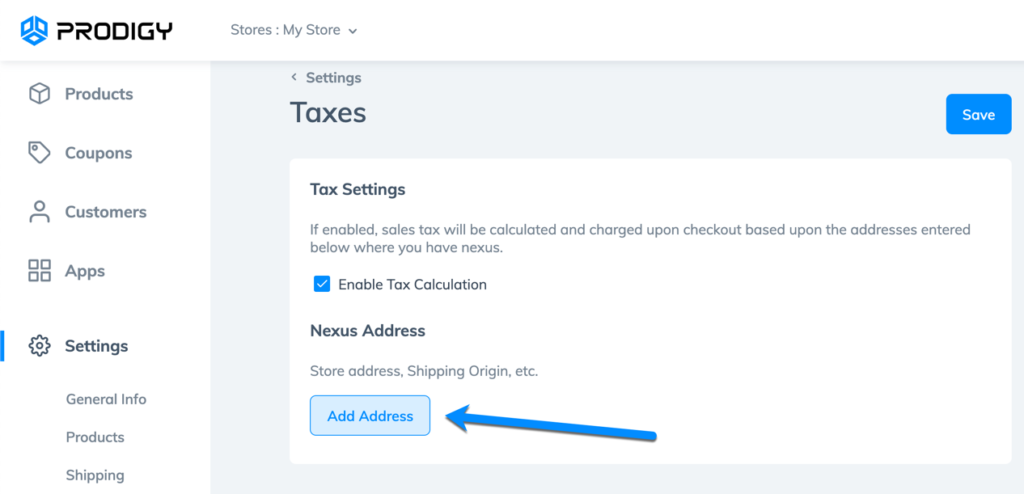

If you’re no longer in the onboarding stage, you can always access Prodigy’s tax features by going to Settings > Taxes in the main menu.

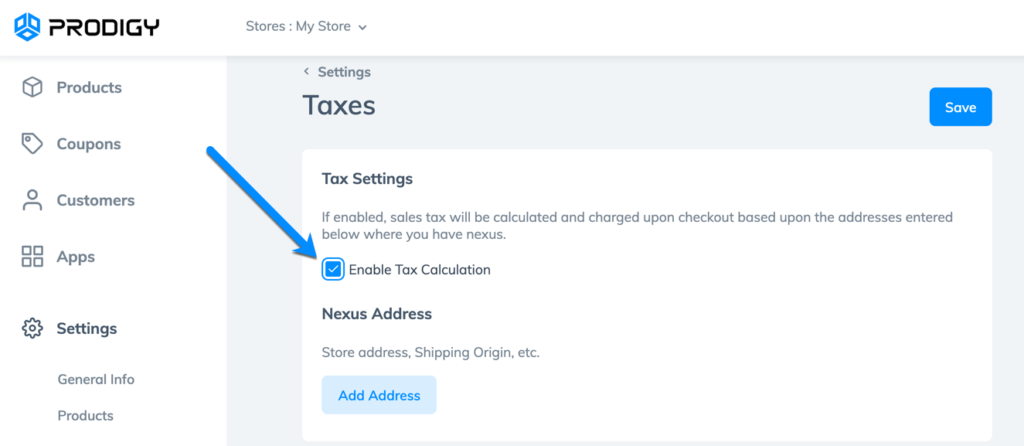

Once on the Taxes page, you must check the box to Enable Tax Calculation. That activates the integrated tax features for your store.

It’s also important to insert a nexus address to enable accurate, automated tax calculations based on the location of your business.

Click Add Address to complete that process.

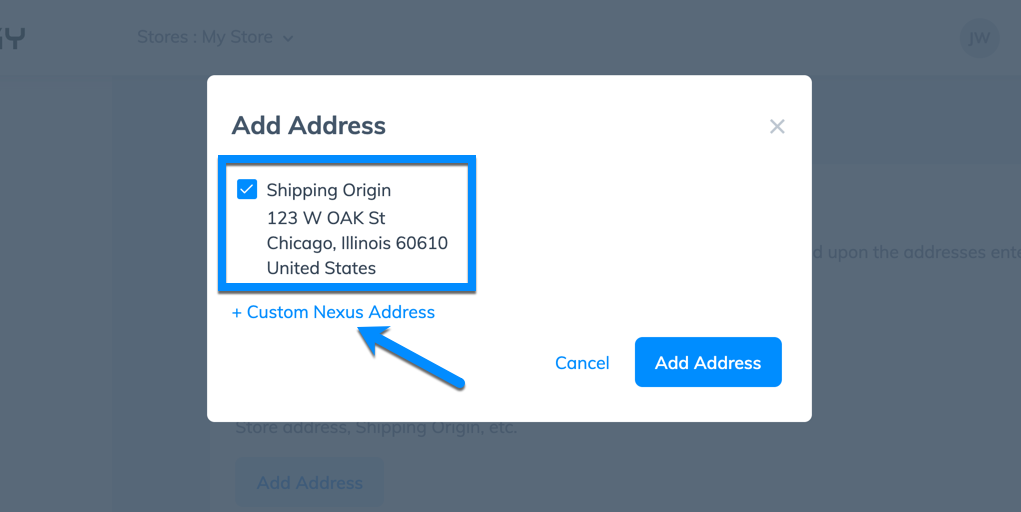

If you already have a Shipping Origin inserted for your store, that location appears as an option. Feel free to choose the Shipping Origin and click the Add Address button.

To include additional nexus addresses, or to replace the default Shipping Origin option, click on the + Custom Nexus Address link.

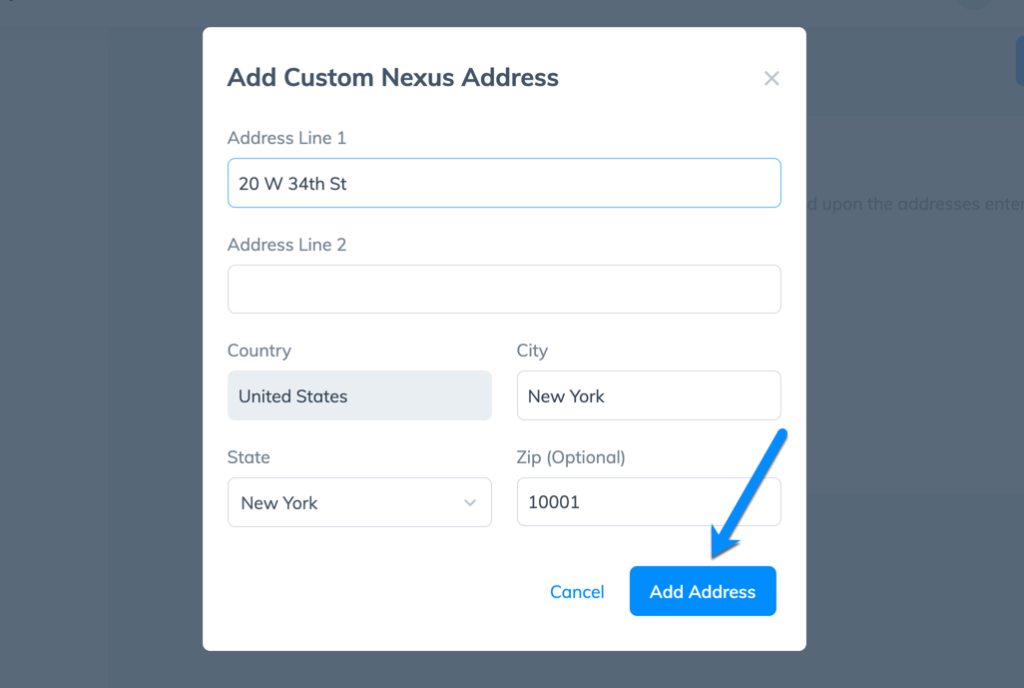

Type in the address details, then select Add Address.

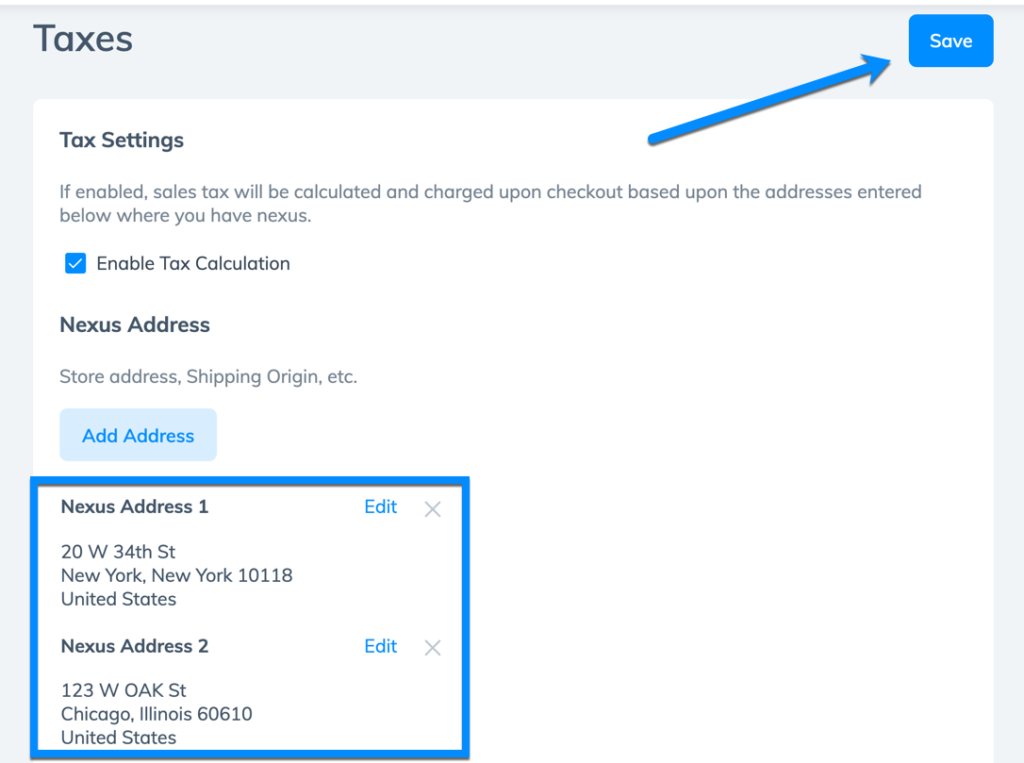

Each nexus appears in a list at the bottom of the Taxes page. Prodigy supports an unlimited number of nexus addresses, and you can always edit, delete, or add addresses in the future.

Click the Save button to render these changes and start running tax calculations!

Sign Up with Prodigy Commerce for Free, Fully Automated Tax Calculations

Taxes are confusing enough already, so it’s time to consider a new, simpler tax calculation tool for your WordPress store owner clients that won’t cost them a cent.

You can create a free Prodigy account today and read our introductory guide to learn why the Prodigy platform for WordPress solves many WooCommerce store owner pain points.

If you have any questions, you can always reach out to the Prodigy customer support team via email, phone, or chat.