Payment processing, or the system in which transactions flow through an eCommerce store, has been broken for a long time.

The basics are there: quick integrations with eCommerce platforms, near instant account approvals, and sleek dashboard interfaces. And you can find these features from common “payment processors” like PayPal, Square, and Stripe.

It’s no wonder online merchants and developers forget about the many downsides to payment middlemen.

And that’s one of the most important misconceptions about “payment processors.” Those old reliables like PayPal and Square aren’t actually payment processors at all, but rather “payment facilitators.”

What’s a Payment Facilitator?

Unbeknownst to many store owners and developers, eCommerce payment solutions like Square, Stripe, and PayPal aren’t true payment processors. Instead, they’re what we call “payment facilitators.”

This means they act as intermediaries, or middlemen, between your business and the actual payment processing configuration. You pay them for the instant payment integration and account approval on platforms like Shopify and WooCommerce.

They’re able to leverage their choice to accept merchants with poor, or minimal, track records by limiting transaction fee negotiations and by adding hidden fees and restrictions that include the slowing down of payouts and significant roadblocks for chargeback management.

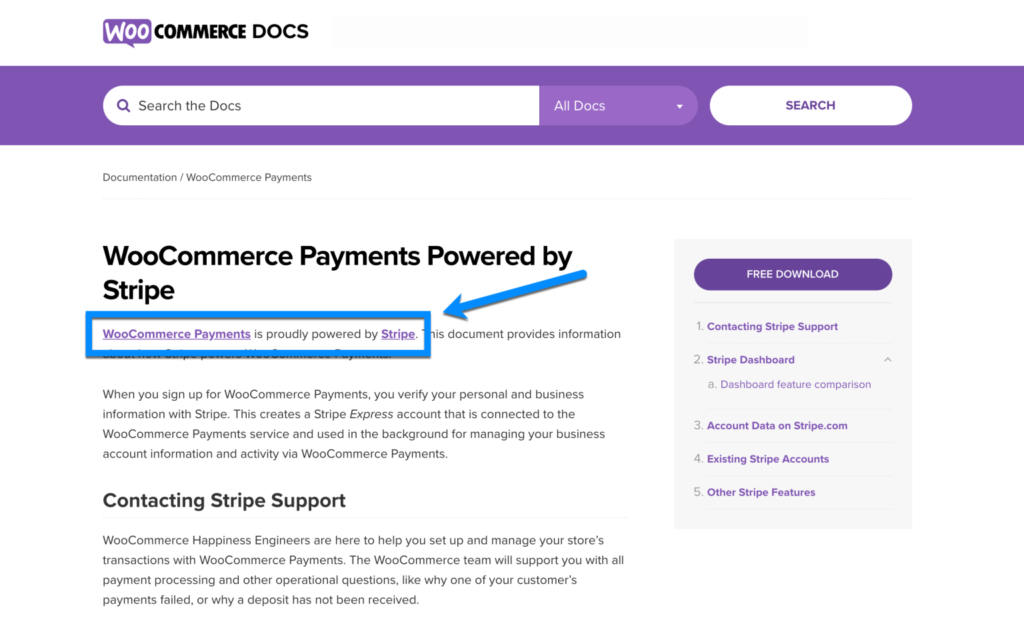

Furthermore, popular eCommerce platforms tend to mask their involvement with these facilitators: Shopify Payments and WooCommerce Payments are simply white-labeled versions of Stripe, so you still get stuck with the disadvantages of payment facilitators.

Reasons Payment Facilitators Seem Appealing (But Actually Aren’t)

The main appeal comes in two forms:

- Developers enjoy facilitators since they’re easy to integrate with Shopify, WooCommerce, and other eCommerce platforms.

- Store owners like the instant gratification of immediate account approval.

It doesn’t help that companies like Stripe and PayPal have massive marketing budgets, so they’re often the ones you hear about, and they usually seem like the only option.

So What’s the Alternative?

If the major eCommerce platforms push you to Stripe or Square, and just about any online search of “payment processing” renders the same results, how do online store owners and eCommerce developers get around this problem?

The answer is to form a direct relationship with an actual payment processor and skip the whole payment facilitator situation altogether.

As a result, you obtain a more transparent, straightforward relationship with advantages ranging from expedited chargeback management to negotiated transaction fees. Not to mention, the payment processing (when handled on Prodigy Commerce) is already activated on the store instead of having to integrate a plugin or app.

That’s why Prodigy Commerce partners with several payment processors without any sneaky white-labeling. WordPress developers and store owners maintain full control of the relationship, receive a higher-quality, potentially lower-fee processor, and near-immediate processing functionality, seeing as how the payment system is already built into Prodigy Commerce.

Having a Direct Relationship with a Payment Processor vs Using a Facilitator

| Processor vs Facilitator | Direct Relationship with a Payment Processor through Prodigy | Using a Payment Facilitator like Stripe, PayPal, or Square |

|---|---|---|

| An Already Installed Payment Processor? | Yes. | No. |

| Quick Integration w/ eCommerce Platform? | It’s already installed. So no integration is needed. | Yes. |

| Account Approval Timeline | Usually within 24 hours. | They say you’re approved immediately, but it can actually take up to six months. |

| Middleman | No. | Yes. |

| Easy Chargeback Management? | Yes. | No. |

| Quality Customer Support? | Yes. | No. |

| Simple Accounting? | Yes. | No. |

| Potential for Negotiated Rates? | Yes. | No. |

As you can see, going for a payment facilitator like Stripe does give you the advantage of an almost immediate account approval. That may bode well for store owners with questionable financials, but Prodigy prefers the route of giving responsible merchants better rates in the long run, in exchange for a sometimes slightly longer approval process (but not by much). You’re also not technically getting approved right away by payment facilitators (more on that in the following sections).

Furthermore, a direct relationship with a payment processor, through the Prodigy Commerce platform, cuts out the middleman and provides an onslaught of benefits like negotiated rates, acceptance of more transactions, cleaner accounting, efficient chargeback management, and improved customer support.

Check out the following sections for an in-depth look into each advantage.

Advantages of Direct Relationships with Payment Processors

There are several important reasons why it’s better for store owners to have a direct relationship with a payment processor as opposed to working through payment facilitators.

1. There’s No Middleman to Block Transactions

A payment facilitator such as Stripe or Square always has some sort of technology to monitor and manage transactions that occur between your customers and the card-issuing banks.

That technology enables them to decline transactions without your consent or knowledge.

An example of this type of technology is Stripe’s Radar feature, a rules-based fraud blocking mechanism with options for store owners to adjust settings for a more liberal acceptance policy.

But hold on, it detects and blocks fraud? That sounds like a good thing, right?

Absolutely. Fraud protection and card declining make for a safer online store. The problem occurs where Stripe fails to consult with any other party before the block, and they don’t tell the merchant when transactions are prevented.

As a result, store owners lose customers and never learn about how or why.

A Better Way

Prodigy Commerce solves this problem with its direct payment processing partners.

Payment declines happen like this:

- The card issuer can still decline the transaction.

- If all is well with the issuer, Prodigy asks the store owners to make the call.

- The store owner uses Prodigy’s free, integrated MaxMind minFraud analysis tool to inform their decision.

Unlike Stripe and other payment facilitators, Prodigy doesn’t decline transactions without the store owner’s knowledge. Yet the merchant continues to have high-quality fraud detection in the process.

2. Chargebacks are Easier to Manage

As with most industries, it’s easy to surmise that a middleman in the eCommerce payments game means slow, potentially tedious processes.

That’s no different with payment facilitators, seeing as how they draw out the process for chargeback management disputes and investigations. That’s because the store owner’s response and documentation gets sent through the likes of Stripe or PayPal first, then to the payment processor.

A Better Way

Prodigy Commerce doesn’t act as a middleman. Instead, store owners have direct relationships with their payment processors. As a result, the chargeback documentation and responses go right to the processor.

3. You Receive Superior Customer Service

Payment facilitators draw praise from developers due to their easy integrations with eCommerce platforms, but what about when dedicated, quality customer service is needed?

Store owners already know of painful experiences dealing with customer support from companies like Stripe and PayPal. Sometimes it’s almost non-existent, or you’re left to research through heaps of online documents on your own.

A Better Way

Prodigy Commerce offers a direct customer support team with real, knowledgeable people, just in time for that question about chargebacks or rate negotiations with the payment processor.

4. Clear Sales and Expense Numbers

ECommerce bookkeeping usually occurs on a daily and monthly basis. When partnered with a payment facilitator like Square, store owners are paid on a net basis and receive daily reports that reflect such.

That means your receipt of funds and reports factor in expenses for each transaction, like the transaction fee.

As a result, individual transaction numbers don’t match up with your store’s analytics. You’re left with extra bookkeeping work to record individual fees as expenses and clear the remaining balance of each receivable.

A Better Way

Payment processors on Prodigy Commerce fund store owners daily on a gross basis and that’s how they report.

Therefore:

- Individual transactions easily match up.

- It’s straightforward to account for the cash and relieve the related receivables each day.

- The payment processors debit the store owner’s bank account for all accumulated fees on the first day of the subsequent month.

With this configuration, the store owner is able to record one transaction for all monthly fees and spend less time on their daily bookkeeping.

5. Potential for Negotiated Rates

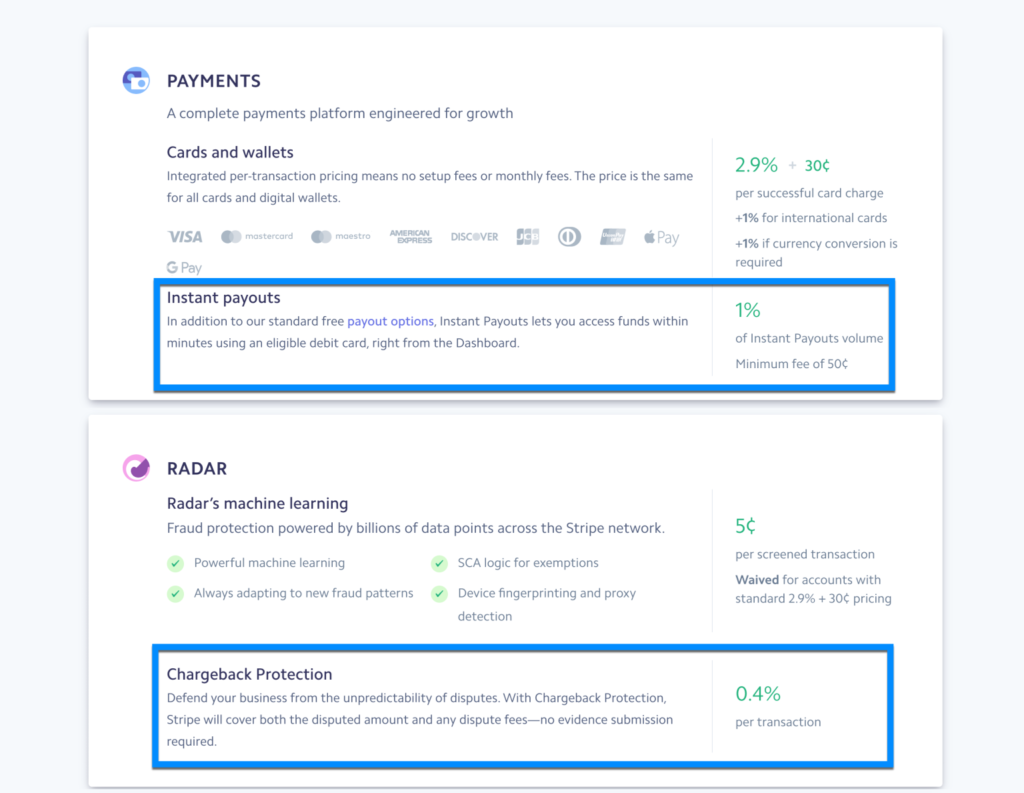

The Stripes and PayPals of the world tend to start their transaction fee rates at 2.9% + $0.30 per transaction.

That includes approval for stores with no track records, which makes sense, until you realize that the standard 2.9% + $0.30 rate is higher than is necessary for some stores.

It’s used as a buffer to protect Stripe and Square from those merchants with no track records. And that often means that even strong, high-earning stores have limited negotiating power with their payment facilitator.

A Better Way

Prodigy, with its comprehensive knowledge of the payment processing industry, leverages its expertise to help store owners find the best payment processors offered through its platform. That means Prodigy can assist in finding you the best rates through negotiation and comparisons.

Most store owners start with the standard 2.9% + $0.30 transaction fee, but well-performing stores allow Prodigy to negotiate. In addition, stores with solid track records migrated to Prodigy from other platforms start the negotiation based on recent sales volume.

How Store Owners Gain Access to a Direct Payment Processing Relationship Through Prodigy

Payments through Prodigy Commerce may work a little differently than what you’re used to. The benefits are there, but this step-by-step process clarifies how easy it is to get started.

Here’s how it works:

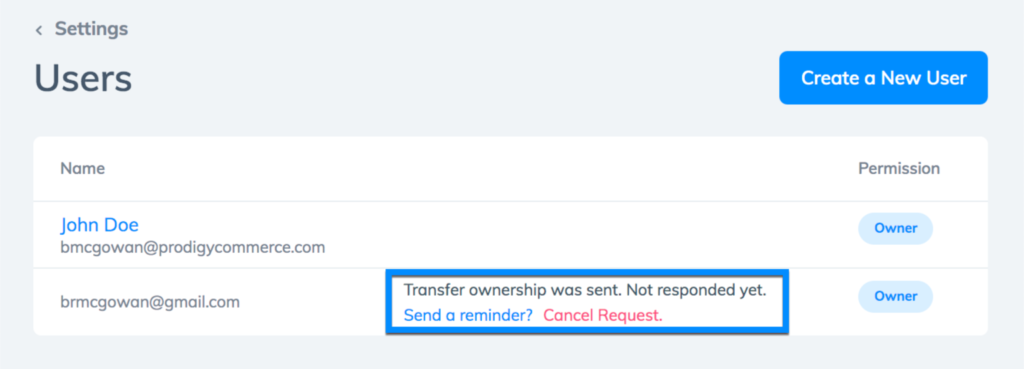

- The WordPress developer is assigned the Owner user role while creating and implementing an online store through Prodigy.

- The developer eventually transfers control of the store to the site owner.

- The store owner provides basic personal information to establish a merchant account application.

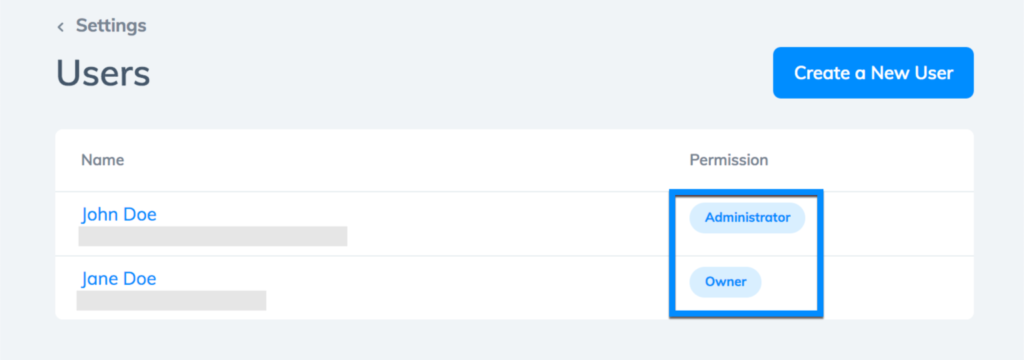

- The developer gets switched to an Administrator user role.

- The site owner receives the Owner user type with full control of the site and payments.

Finally, the site owner has the option to either change the developer’s user role or completely remove them from the system.

The Approval Process

Let’s compare the steps required to get approval for both payment facilitators like Stripe (and what goes on behind the scenes) and a direct relationship through one of Prodigy’s processors.

Approval Through Payment Facilitators

- Store owners get “approved,” but that’s not really the case. It’s a tactic used to present a speedy approval environment. Most of these are automated to bring in as many customers as possible.

- Underwriting (checking financials) happens later when the store generates enough payment activity.

- If a store doesn’t produce enough sales, what sales have occurred aren’t funded until after 7 – 14 days.

- The payment facilitator may also opt to hold your store’s money in a reserve.

- If a store doesn’t actually get approved, funds can be held for up to six months or partially transmitted to the store owner (if the risk of chargebacks is low).

- If formally approved, store owners receive all processed funds in two days (faster for an extra fee).

Approval Through Prodigy’s Payment Partners

- Prodigy provides a “white-glove” service where each store owner’s merchant application is personally reviewed.

- Prodigy helps store owners fill out the application if necessary.

- After the application is done, Prodigy seeks out the store’s best fit from amongst the payment processors on its platform.

- Store owners with good credit and selling commonplace products (with potential sales of under $1 million per year) get approved within 24 hours without any extra documentation required.

- Approved merchants receive all funds from sales the next day without any extra fees.

Sign Up for Stronger, Simpler Payment Processing with Prodigy Commerce

Unlike payment facilitators like Stripe, PayPal, and Square, there are no tricks or hidden fees with Prodigy. It’s also easier for WordPress developers and store owners with advantages such as faster payouts, efficient chargeback management, superior customer service, and the potential for negotiated rates.

To learn more about Prodigy’s eCommerce platform for WordPress, and to take advantage of payment processing that’s made for your company’s success, contact us at support@prodigycommerce.com or start your store here.

For more information, read our Introduction to Prodigy Commerce here.